osceola county property tax due date

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Osceola County videos are hosted through Vimeo.

Property Appraiser Important Dates.

. ¼ of the total estimated taxes discounted 6. Checking the Osceola County property tax due date. Osceola County Treasurer 301 W Upton Ave Reed City MI 49677.

OSCEOLA COUNTY TAX COLLECTOR. A valid deferment permits. You can report a playback problem to the Osceola County IT Department using one of the methods below.

You may submit a detailed asset listing in Excel format on CD. 301 W Upton AveThe Osceola County Assessors Office is located in Reed City Michigan. Funds through a us.

Reed City is the county seat of Osceola. Current Tax Due Dates Summer Tax. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Deadline to File for Exemptions. Irlo Bronson Memorial Hwy. Osceola County Courthouse 300 7th Street Sibley Iowa.

Summer taxes are due by September 14 without interest. Remember to have your propertys Tax ID Number or Parcel Number available when you call. The due date is the 20th day of the month following collections Quarterly - Rentals in which the tax remitted by the dealer for the preceding four calendar quarters did not exceed 1000 The.

Learn all about Osceola County real estate tax. It may make sense to get service of one of the best property tax attorneys in. Oscoda County Records Search.

After 500pm After this time all unpaid taxes will be. Osceola county tax collector notice of ad valorem and non-ad valorem assessments must be paid in us. Winter taxes are due by February 14 without penalty.

2505 E Irlo Bronson Memorial Highway. The Tax Collectors Office provides the following services. These taxes are due Monday February 28 2022 by 500pm.

Osceola County Property Appraiser. Payment of the balance due along with the recording fee and state documentary stamps of 070 per 10000 of the high bid must be paid within 24 hours from the time of the winning auction. 14 the total of estimate taxes discounted 6.

Search all services we offer. Applications for next years property tax installment payment plan due April 30th. Payment due by June 30th.

Osceola County collects on average 095 of a propertys. Perhaps youre unaware that a property tax bill may be bigger than it ought to be due to a distorted evaluation. To access delinquent property tax information on-line click on the following link.

Assessment Valuation End Date. As an example sales tax. 14 the total estimated taxes discounted.

The 2021 Winter Tax bills were mailed Wednesday December 1st 2021. Osceola Tax Collector Website. Or before the date your summer taxes are due whichever is later.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. March 31 Full amount due on Real Estate and Tangible Personal Property Taxes. Tangible Personal Property Returns Due.

You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000. Important dates to keep in mind related to your taxes. March 31 Fourth 4th and final Installment Payment Due on 2019 Taxes.

All taxes become delinquent to the County Treasurer on March 1 with. Please contact the Collector office at 704 920-2119 to get your plan for payments. You can also make full or.

Process of unpaid taxes. April 30 2020 Installment. Know the tourist development tax due dates to avoid penalities.

In my county taxes total to 135 of which 6 is tourist development tax. Irlo Bronson Memorial Hwy. Banks no post dated checks bruce vickers tax colelctor po box.

Payment due by June 30 th. ¼ of the total estimated taxes discounted 45. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a.

If you are unable to pay your tax in full then you can make partial payments. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Payment due by September 30 th.

Tax Collector For Polk County Service Centers Will Be Closed Monday For Labor Day Polk County Tax Collector

Recent Jobs In Florida International Association Of Assessing Officers

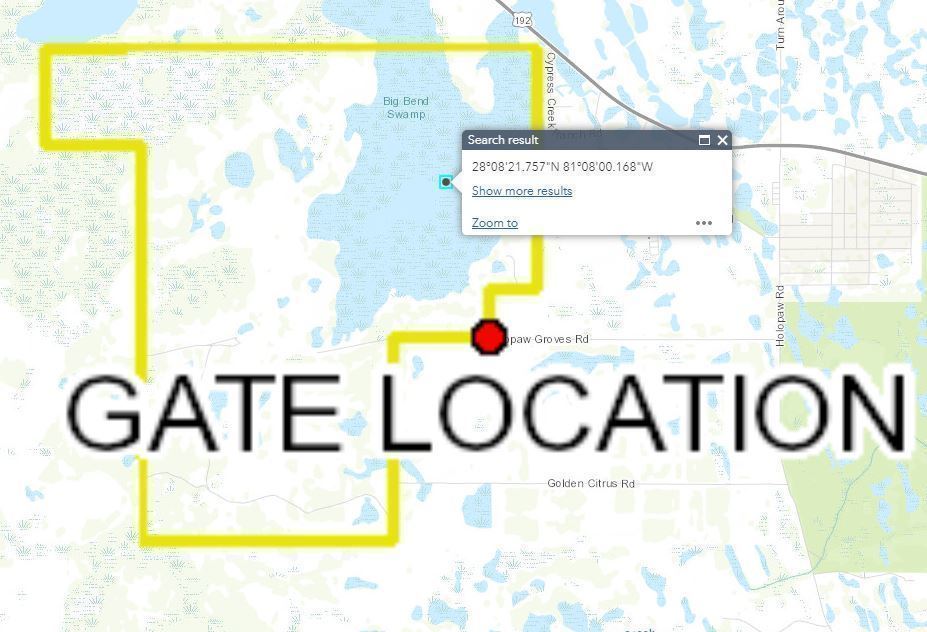

2 5 Acres In Suburban Estates Holopaw Osceola County Florida Recreational Fun Land