how much tax is taken out of my paycheck indiana

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. These are the rates for.

Indiana Nanny Tax Rules Poppins Payroll Poppins Payroll

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

. Some states follow the federal tax year some. Use this tool to. It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond.

Indiana Hourly Paycheck Calculator. The amount of federal taxes taken out. However they dont include all taxes related to payroll.

10 12 22 24 32 35 and 37. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. How much tax is taken out of 15 an hour.

The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. Divide this number by the gross pay. Your bracket depends on your taxable income and filing status.

How Your Indiana Paycheck Works. FICA taxes consist of Social Security and Medicare taxes. How much are payroll taxes in Indiana.

The Indiana Paycheck Calculator will help you determine your paycheck. Our calculator has recently been updated to include both the latest Federal Tax. The state tax year is also 12 months but it differs from state to state.

There are seven federal tax brackets for the 2021 tax year. As an employer you must match this tax dollar-for. You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202223.

All you need to do is enter the necessary information from the employees W-4 form pay rate. Both employee and employer shares in paying these. How much taxes do they take out of 1000.

FICA taxes are commonly called the payroll tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Indiana Hourly Paycheck and Payroll Calculator. Just enter the wages tax withholdings and. Need help calculating paychecks.

That means that your net pay will be 43041 per year or 3587 per month. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4.

Choose an estimated withholding amount. But on top of state income taxes each county charges its own. Your average tax rate is.

185 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. Indiana State Payroll Taxes Its a flat tax rate of 323 that every employee pays. See how your refund take-home pay or tax due are affected by withholding amount.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Indiana Salary Paycheck Calculator. Estimate your federal income tax withholding.

Indianas statewide income tax has decreased twice in recent years.

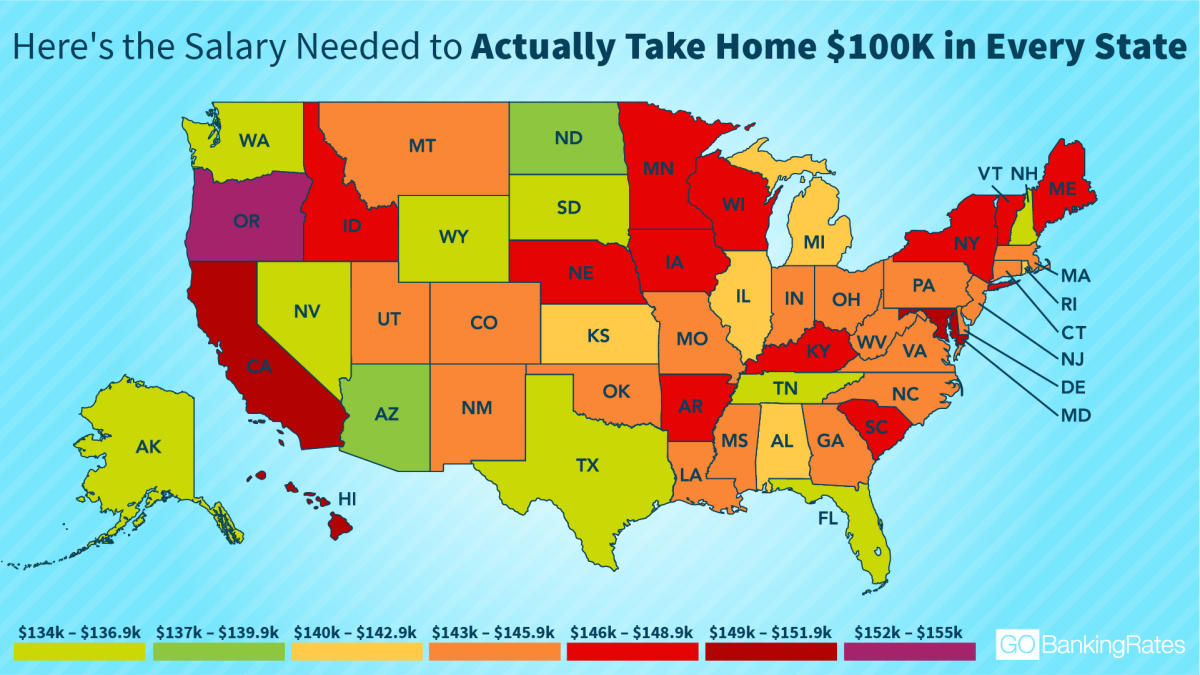

This Is The Ideal Salary You Need To Take Home 100k In Your State

Indiana Paycheck Calculator Adp

Dearborn County Income Tax Increase Now In Effect Eagle Country 99 3

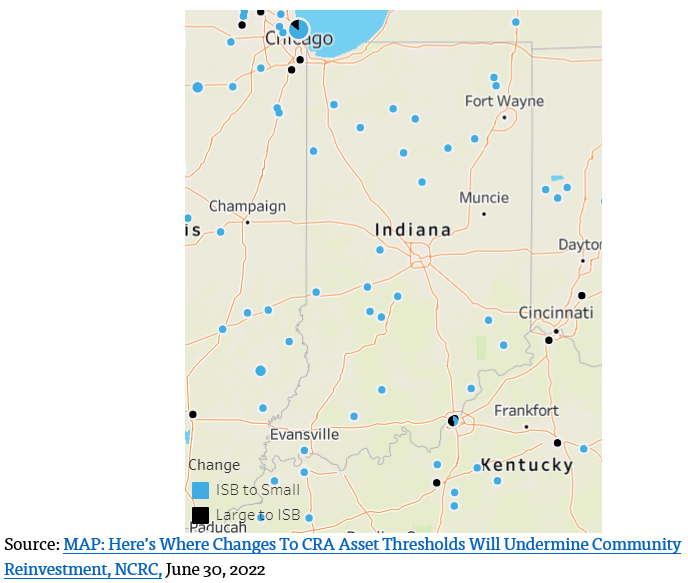

Prosperity Indiana Policy News

Tax Withholding For Pensions And Social Security Sensible Money

Indiana Paycheck Calculator Adp

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Indiana Payroll Tools Tax Rates And Resources Paycheckcity

How Much Tax Is Taken Out Of Indiana Paycheck

Free Paycheck Calculator Hourly Salary Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

State Income Tax Rates And Brackets 2022 Tax Foundation

Indiana Paycheck Calculator Tax Year 2022

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Indiana Salary Calculator 2022 Icalculator

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck